Pursuing higher education is a significant goal for many students, but the escalating costs can make it seem unattainable. Over the past two decades, tuition and fees at public four-year institutions have risen by 141%, averaging an annual increase of 7.0%.

The encouraging news is that affordable options do exist. Recent data indicates that the average net tuition prices for students at public institutions are lower today than in the 2006-07 academic year, suggesting that with strategic planning and informed decision-making, securing a quality education without exhausting your finances is achievable.

This guide provides practical strategies to identify colleges that align with your budget. We will explore key tactics, financial aid opportunities, and tips to help students and families make informed choices—ensuring educational aspirations are met without compromising future financial stability.

Navigating the Complexities of College Costs

Before venturing into ways to find affordable colleges, it’s essential to familiarize yourself with the various costs and expenses associated with higher education. The typical college costs can be categorized as follows:

- Tuition and Fees: This is the most substantial expenditure as it covers academic instruction, access to campus facilities, and student services. Tuition rates can vary significantly based on the type of institution—private or public—as well as its location and prestige.

- Room and Board: This includes housing expenses and the cost of meals. While residing on campus is convenient, it can sometimes be pricier than external housing alternatives.

- Books and Supplies: Expenses for textbooks, essential course materials, and other required supplies tend to accumulate rapidly, particularly in specialized fields.

- Transportation: Commuting to campus or local travel can be a notable expense, particularly for those living far away from their colleges.

- Personal Expenses: This category involves everything from toiletries and laundry to dining out and social activities. Personal costs can fluctuate greatly depending on lifestyle choices and spending tendencies.

Recognizing these expenses is the first step to creating a realistic budget and finding ways to save.

How College Tuition Has Changed: The Rising Cost of Higher Education

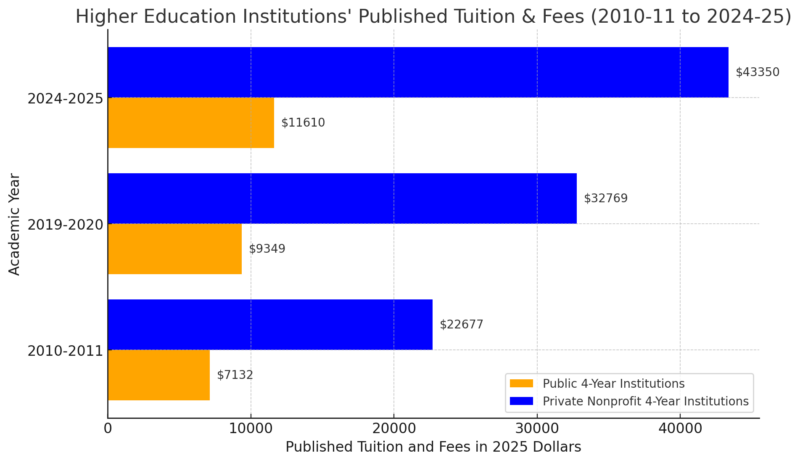

The cost of a college education has escalated dramatically over the past decade, making it harder for students and families to afford tuition without financial strain. Public four-year institutions, once considered a more affordable option, have seen steady price increases, while private nonprofit universities have nearly doubled their tuition costs.

The following chart provides a clear comparison of tuition and fees (adjusted for inflation) at both public and private institutions from 2010-11 to 2024-25. Understanding these trends is the first step toward making informed financial decisions about higher education.

The histogram illustrates inflation-adjusted tuition and fees from 2010-11 to 2024-25 for both public four-year institutions and private nonprofit four-year institutions.

- Public four-year institutions have seen tuition climb from $7,132 in 2010-11 to $11,610 in 2024-25, reflecting a 63% increase in inflation-adjusted terms.

- Private nonprofit four-year institutions (blue bars) have witnessed an even steeper rise, jumping from $22,677 to $43,350, nearly doubling in just over a decade.

These figures highlight the widening gap in costs between public and private institutions. While private universities charge significantly more, both categories have experienced steady price growth. The rising financial burden makes early planning, financial aid utilization, and strategic decision-making essential for students aiming to minimize college expenses.

This data reinforces the need for exploring budget-friendly college options, leveraging scholarships, and considering alternative education pathways—all of which will be covered in the following sections.

Tactics for Discovering Affordable Colleges

Here are various tactics to assist in finding affordable colleges:

1. Begin Early and Plan Ahead

Starting your college planning early enhances your ability to make informed decisions. Research indicates that early planning can significantly improve educational outcomes and lead to long-term financial benefits, with students potentially saving an average of $33,000 on college tuition.

- Look Beyond Tuition Costs: Use reliable sources to compare college expenses, but don’t stop at tuition. Check out financial aid options, scholarships, and work-study programs to see the full picture of what you’ll actually pay.

- Start Saving Early: Even small contributions add up over time. Setting aside money as soon as possible—especially in a 529 college savings plan—can make a big difference, thanks to tax benefits and long-term growth.

- Boost Your Academic Profile: Stronger grades and extracurricular involvement can open doors to merit-based scholarships. Challenge yourself with tougher courses, stay consistent with your studies, and take advantage of every opportunity to stand out.

2. Look Into Public Colleges and Universities

Generally, public colleges and universities are more budget-friendly compared to private universities, especially for residents of the state. These institutions rely on government funding, allowing for lower tuition costs.

- Consider In-State Colleges: Attending a public college in your state can significantly reduce costs due to lower tuition rates for residents.

- Check Smaller Regional Universities: Small, regional institutions might provide exceptional academic opportunities at a fraction of the cost of larger flagship schools.

- Assess Community Colleges: Community colleges can serve as a cost-effective means to earn college credits. Many students find it advantageous first to attend a community college before transferring to a four-year institution.

3. Make the Most of Financial Aid Opportunities

Financial aid has the potential to substantially lessen college costs. It’s crucial to explore every financial aid possibility, including grants, scholarships, student loans, and work-study arrangements.

- Complete the FAFSA: The Free Application for Federal Student Aid is essential for determining eligibility for federal financial assistance and is key to accessing grants, loans and work-study opportunities.

- Look for Scholarships: Scholarships are great as they do not require repayment. Many organizations provide scholarships, including educational institutions, local entities, and online resources. Sites focused on affordable programs can also guide you.

- Engage in Work-Study Programs: Consider work-study roles, where you can earn money while still studying. It helps alleviate college expenses and nourishes your work experience.

- Investigate Federal and State Grants: Grants don’t require repayment. For example, Pell Grants are available for those who demonstrate financial need, and many state grant programs can help certain students.

4. Seek Alternative Housing Possibilities

Room and board can prove to be a significant financial burden; considering alternative housing can help lessen these costs.

- Live at Home: If it’s a viable option, staying at home can significantly minimize costs. While it may not suit everyone’s circumstances, it’s certainly a way to save cash.

- Browse Off-Campus Rentals: Renting an apartment off-campus can frequently be cheaper than residing in on-campus lodgings. Finding a roommate can also split the costs, making it more affordable.

- Become a Resident Assistant: Serving as a resident advisor can get you free or discounted housing. This position not only saves cash but also enables you to acquire valuable experience and skills.

5. Expect and Mitigate Textbook Expenses

Textbooks can put a dent in your wallet, but you can find ways to keep these expenses down.

- Buy Used Textbooks: Opt for used books as they are usually cheaper. Check forums, online stores, and campus marketplaces for bargains.

- Think about Renting Textbooks: Renting textbooks from bookstores or online platforms is often more economical than making purchases, especially for courses that you won’t retake.

- Ponder Digital Versions: Consider using digital versions of textbooks, as they are typically less expensive than print editions while also being more versatile on various devices.

- Share with Classmates: Textbook sharing among friends can also greatly cut down costs, allowing everyone involved to save money.

6. Limit Personal Expenses

Being cautious about personal spending is essential as these costs can spiral quickly.

- Keep Personal Expenses in Check: Small purchases add up fast, so staying mindful of spending habits can prevent unnecessary financial stress.

- Create a Simple Budget: Track your income and expenses to see where your money goes. A clear budget makes it easier to spot areas where you can cut back.

- Avoid Impulse Buys: Think twice before spending on things you don’t really need. Sticking to essentials helps stretch your budget further.

- Take Advantage of Student Discounts: Plenty of stores, restaurants, and services offer student discounts—use them whenever possible to keep costs down.

- Cook More, Eat Out Less: Dining out gets expensive fast. Preparing meals at home saves money and gives you more control over your spending.

Making Thoughtful Choices

Choosing the right college isn’t just about academics—it’s a financial decision that impacts your future. Taking time to explore options, compare financial aid, and make smart choices about housing, textbooks, and personal expenses can keep costs manageable.

Start early, stay organized, and use every available resource to lighten the financial load. With careful planning and a proactive mindset, finding an affordable college and setting yourself up for success is absolutely an attainable reality.